FCRA Attorneys Help Consumers with Credit Report Errors

At The Adkins Firm, our experienced FCRA attorneys address one of the most common concerns consumer face: errors on credit reports….

Read More →

At The Adkins Firm, our experienced FCRA attorneys address one of the most common concerns consumer face: errors on credit reports….

Read More →

Learn five expert strategies to safeguard against identity theft and fraud in the digital age. From comprehensive tenant screening to active monitoring of financial accounts, empower yourself with proactive measures. Stay informed about emerging threats and protect your financial interests effectively. Safeguard your digital footprint with confidence and resilience.

Read More →

Facing credit report errors? At The Adkins Firm, our FCRA attorneys specialize in rectifying inaccuracies on credit reports. You’re not alone in this frustrating situation. We offer tailored solutions to protect your financial well-being under the Fair Credit Reporting Act (FCRA). Our experienced team guides you through disputing errors, ensuring your rights are upheld. Whether it’s identity theft or clerical errors, we’re here to clear your name. Don’t let credit report errors hinder your financial goals. Schedule a free consultation today to regain control of your financial future. Contact us at (214) 974-4030 for personalized legal support against Equifax®, ExperianTM, and Trans Union®

Read More →

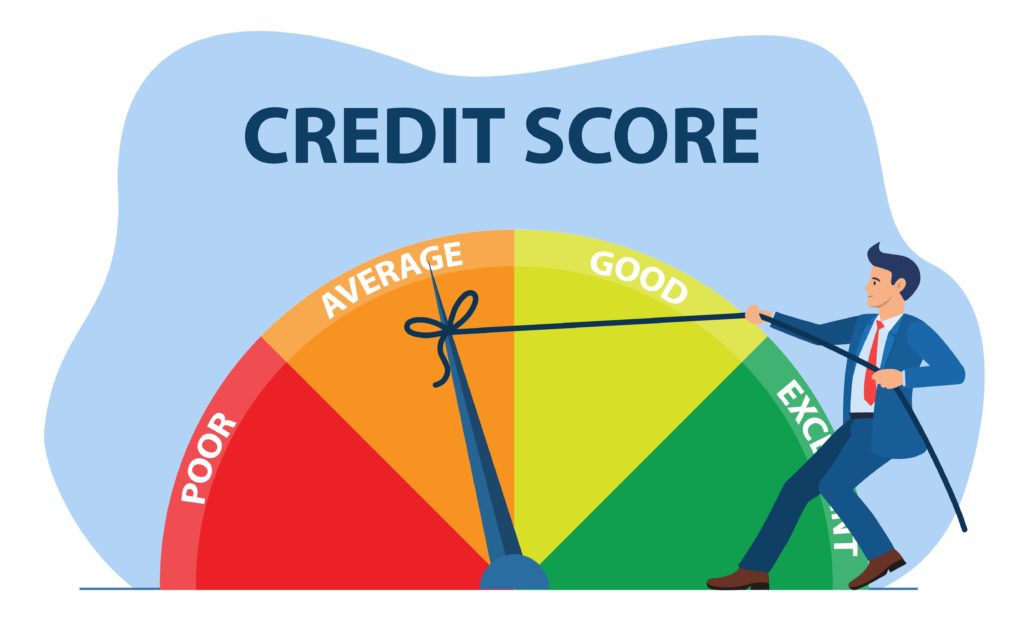

“Discover the impact of credit report errors on your financial health. Learn how inaccuracies can lower your credit score, leading to denied credit or higher interest rates. Our expert advice guides you through disputing errors under the Fair Credit Reporting Act (FCRA) to reclaim your financial reputation. With free consultations and contingency fee arrangements, our experienced FCRA attorneys ensure you receive fair compensation for damages caused by Equifax®, Experian™, and Trans Union®. Don’t let errors harm your credit and financial future. Contact us today at (214) 974-4030 for a free case review and protect your rights before time runs out under the FCRA statute of limitations.”

Read More →

Are you a Colorado victim of identity theft? In 2022, the Federal trade Commission (FTC) received almost 11,000 identity theft complaints…

Read More →Introduction: Pennsylvania Attorney General Michelle Henry recently announced a landmark settlement with Equifax, the Georgia-based credit reporting agency, amounting to…

Read More →

Credit report errors is a common complaint to the CFPB. In fact, the number of credit dispute complaints made to the CFPB more than doubled between 2022 and 2023.

Read More →

Do you have errors on a credit, background or tenant screening report? The Adkins Firm represents clients who have errors on credit reports, background reports and tenant screening reports. Contact us to see if we may be able to help you clear your name.

Read More →

Do you have inaccurate information on your file? Have you ever faced the frustration of being denied financing, job opportunities,…

Read More →

The Fair Credit Reporting Act Protects Consumers Do you have an accurate credit report? Credit reports have a significant influence…

Read More →

Do you have errors on a credit report? Credit reports play an important role in shaping consumers’ lives, influencing decisions…

Read More →

Introduction Your credit report is a critical document that plays a significant role in your financial life. It affects your…

Read More →