What Do People With 800+ Credit Scores Have In Common?

What is the common thread for consumers with 800 plus credit scores?

According to a recent report from Lending Tree, “about 1 in 6 American consumers has a FICO credit score of 800 or higher.” So what do the consumers with 800 scores have in common?

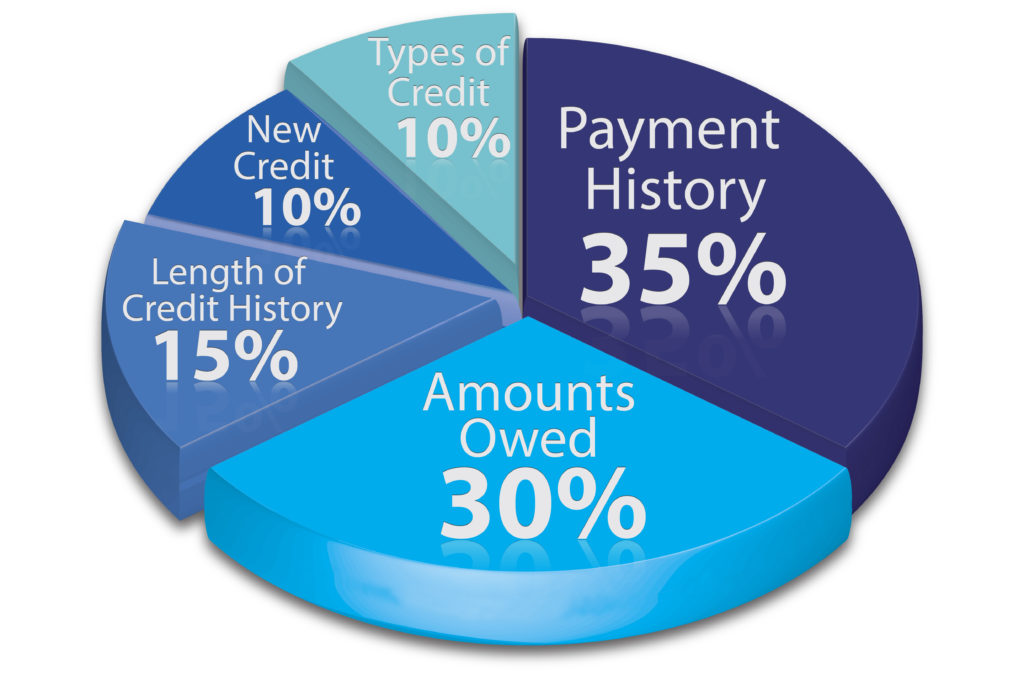

What makes up your credit score?

1. Payments Made On Time

Consumers who have a credit score of 800 or above make payments on time. Payment history makes up 35% of the FICO score, which makes it the highest weighted variable in the FICO score equation. Late payment history during the past 7 years can prevent consumers from having an 800 credit score.

2. Credit Utilization Below 6%

Credit utilization, the amount of money owed in comparison to the available credit, is the second most important variable in the FICO score equation. Generally, balances greater than 30% will reduce a consumer’s credit score. 100% use of available credit can have a devastating effect on a credit score. However, most consumers who have an 800 plus credit score use less than 6% of their credit limits.

3. Years of Credit History

The number of years of credit history makes up the third most important credit score factor. Longer credit history will generally increase credit scores. On average, consumers with 800 plus credit scores had more than 27 years of credit history. Conversely, consumers with little or no credit history will have much lower credit scores.

4. Healthy Mix of Credit Types

A healthy mix of credit types, “such as credit cards, installment loans and mortgages – can help improve your credit score.” The credit mix makes up 10% of the FICO credit score. On average, those with an 800 plus credit score have 7.9 open credit accounts.

5. Low Number of New Accounts and Inquiries

The number of new credit accounts and hard inquiries for the previous 2 years can adversely affect credit scores. The number of new accounts and hard inquires makes up the final 10% of a credit score under the FICO credit score model. On average, consumers with 800 plus credit scores had 2.2 to 2.8 new credit hard inquiries.

Are Credit Report Errors Preventing You from having an 800 credit score?

Credit report errors in any of the above 5 categories can reduce a consumers credit score. Do accounts or hard inquiries appear on your credit report that do not belong to you? Have you disputed the errors and the credit bureaus “verified” the information is accurate?

The Adkins Firm represents consumers with credit report errors and we may be able to help you, too. Contact us for a free case review. Remember, it’s your credit report!