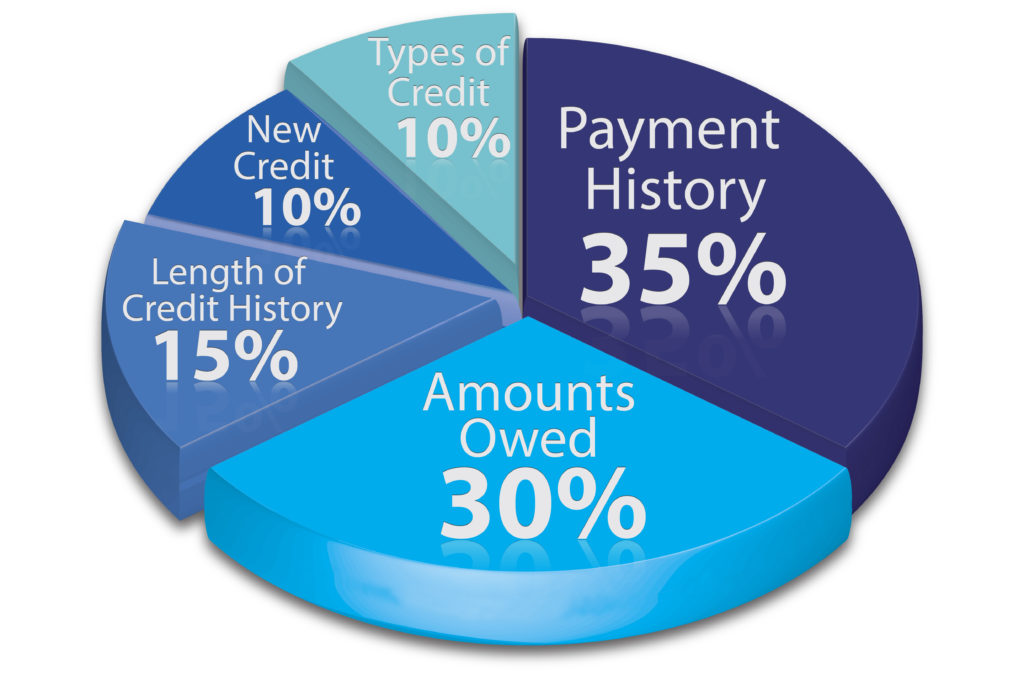

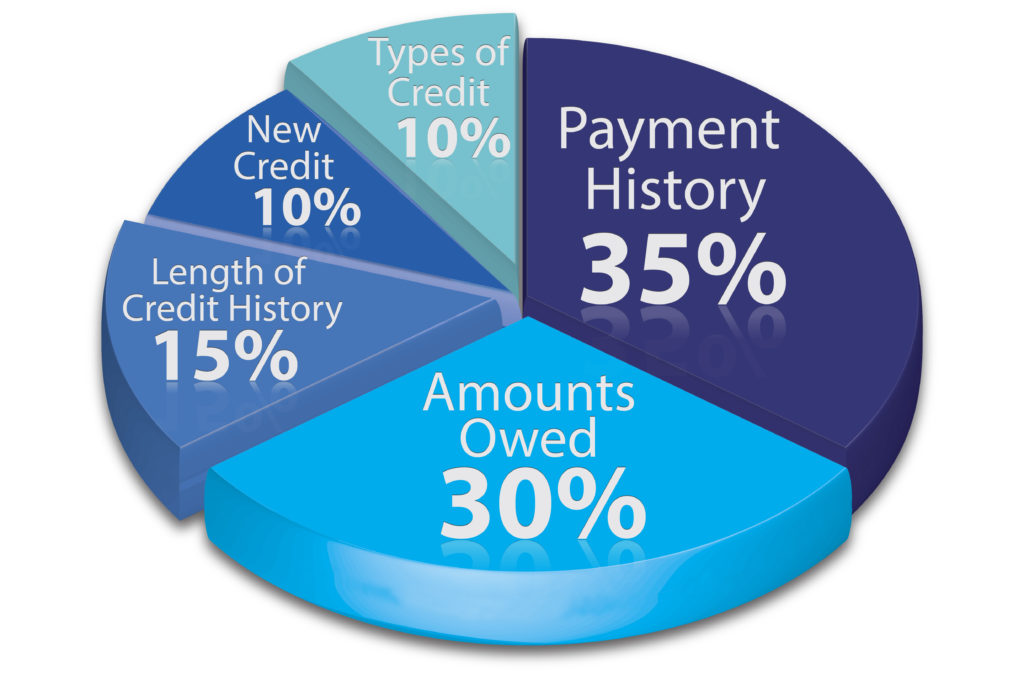

What Do People With 800+ Credit Scores Have In Common?

What is the common thread for consumers with 800 plus credit scores? According to a recent report from Lending Tree,…

Read More →

What is the common thread for consumers with 800 plus credit scores? According to a recent report from Lending Tree,…

Read More →

The AFNI CFPB Investigation Fair Credit Reporting Act compliance just got a big win. The Consumer Financial Protection Bureau (CFPB)…

Read More →

Under the Fair Credit Reporting Act (FCRA) consumers are entitled to one free credit report annually from Equifax, Experian, and…

Read More →

Do you know how to order your free credit reports from Equifax, Experian and Trans Union? We help our clients learn how to order free credit reports and to dispute credit report errors.

Read More →

Got Credit Report Errors? Do you know how to dispute credit report errors?

Read More →

The FCRA’s willfulness standard favors consumers, especially when defendants have information that corroborates the consumer’s dispute.

Read More →

Consumers often contact the Adkins Firm and ask how to get their free credit reports. The Fair Credit Reporting Act…

Read More →

PUBLIC RECORD ERRORS AND CREDIT REPORTS Consumers often contact The Adkins Firm because they have public record errors on their credit…

Read More →

Credit report errors can cause credit denials. According to the Federal Trade Commission, one out of five consumers have credit…

Read More →

The trial court acknowledged Synchrony’s claims shared facts in common; however, because the plaintiff’s claims were made under federal law, the FCRA, and the FCRA does not “expressly or impliedly provide[] a right to indemnity,” the court denied Synchrony’s motion for leave to file the third party complaint. Accordingly, “[f]rom a policy standpoint, therefore, it is difficult to conjure up support for a rule which would allow a furnisher to bring an indemnification action.”

Read More →

CREDIT REPORT DISPUTE LAWYER – Under the Fair Credit Reporting Act (FCRA), there is no private cause of action under 15 U.S.C. § 1681s-2(a). In other words, consumers cannot successfully sue furnishers for reporting false information under the FCRA.

Read More →

Do you have credit report errors? Have you disputed the false information to the credit bureaus? Now What?

Read More →