What Do People With 800+ Credit Scores Have In Common?

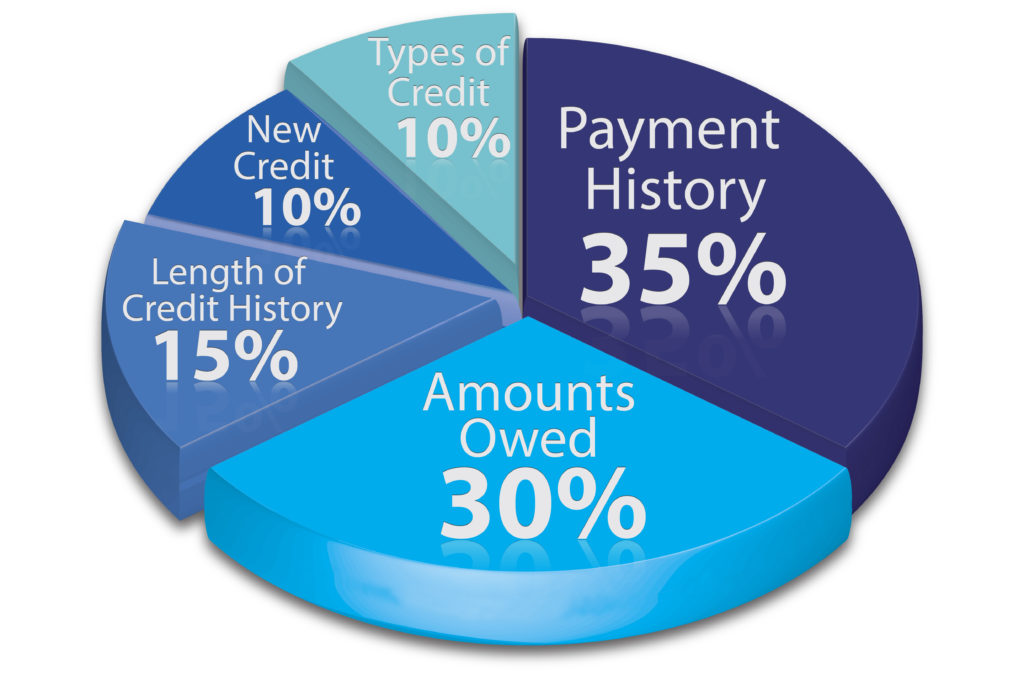

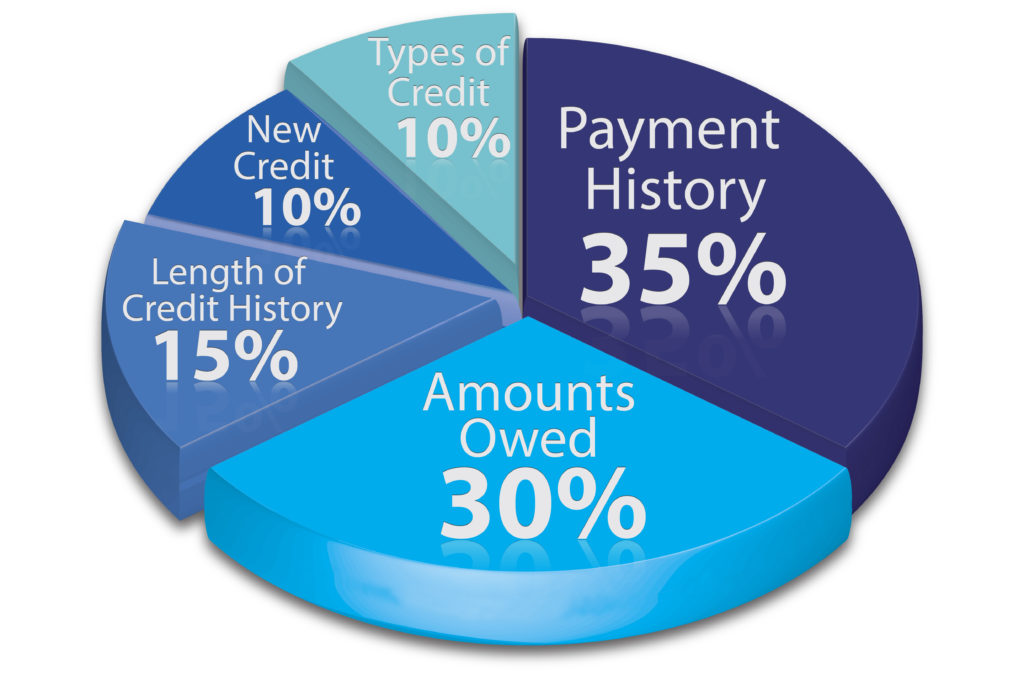

What is the common thread for consumers with 800 plus credit scores? According to a recent report from Lending Tree,…

Read More →

What is the common thread for consumers with 800 plus credit scores? According to a recent report from Lending Tree,…

Read More →

Students at risk for identity theft. As a leading Nashville Identity Theft Lawyer, Micah Adkins routinely sees different types of…

Read More →

Should consumers order their free credit reports online? Consumers are entitled to one free credit report a year. The Fair…

Read More →

Do I have the right to order a free credit report? The federal Fair Credit Reporting Act promotes the accuracy of credit…

Read More →

A federal judge in the Southern District of Indiana granted plaintiff’s motion to compel Trans Union’s discovery responses. Background Plaintiff…

Read More →

What should I do if I am a victim of identity theft? If you are a victim of identity theft,…

Read More →

Equifax’s Motion for Partial Judgment on the Pleadings Denied In Brooks v. Equifax, the court denied Equifax’s Motion for Partial…

Read More →

Got Credit Report Errors? Do you know how to dispute credit report errors?

Read More →

The FCRA’s willfulness standard favors consumers, especially when defendants have information that corroborates the consumer’s dispute.

Read More →

Most people have heard of a consumer reporting agency (CRA), but what is a specialty consumer reporting agency? The Fair…

Read More →

Tenant Screening Reports and the FCRA Landlords run tenant screening reports when potential tenants apply for housing. The cost of the tenant…

Read More →