Mixed Credit Report: What to Do

Do you have inaccurate information on your file? Have you ever faced the frustration of being denied financing, job opportunities,…

Read More →

Do you have inaccurate information on your file? Have you ever faced the frustration of being denied financing, job opportunities,…

Read More →

Introduction Your credit report is a critical document that plays a significant role in your financial life. It affects your…

Read More →

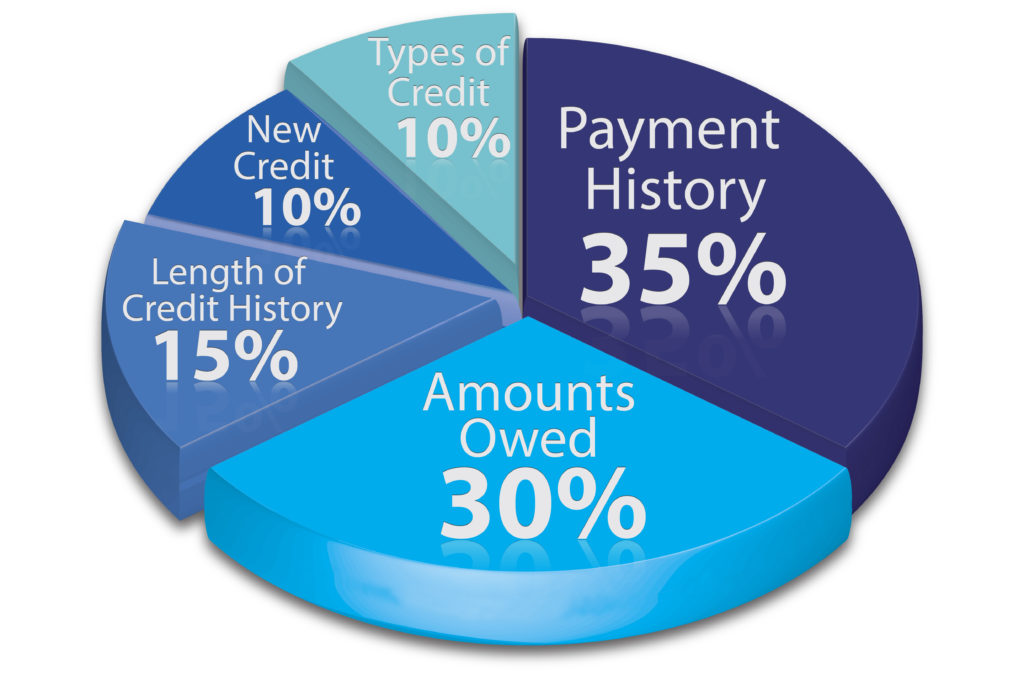

What is the common thread for consumers with 800 plus credit scores? According to a recent report from Lending Tree,…

Read More →

What its ChexSystems? When you apply to open a new bank account, most banks will review a consumer report commonly…

Read More →

What is the Fair Credit Reporting Act? The Fair Credit Reporting Act (FCRA) was enacted in 1970 to protect consumers’…

Read More →

Houston ID Theft – Man Arrested and Accused of Stealing Identity In May, according to Rose-Ann Aragon and Hannah Falcon…

Read More →

Do I have the right to order a free credit report? The federal Fair Credit Reporting Act promotes the accuracy of credit…

Read More →

Under the Fair Credit Reporting Act (FCRA) consumers are entitled to one free credit report annually from Equifax, Experian, and…

Read More →

Do you know how to order your free credit reports from Equifax, Experian and Trans Union? We help our clients learn how to order free credit reports and to dispute credit report errors.

Read More →

Got Credit Report Errors? Do you know how to dispute credit report errors?

Read More →

The FCRA’s willfulness standard favors consumers, especially when defendants have information that corroborates the consumer’s dispute.

Read More →

Consumers often contact the Adkins Firm and ask how to get their free credit reports. The Fair Credit Reporting Act…

Read More →